Content

Go to Accounting ‣ Periodical Processing ‣ End of Period ‣ Generate Opening Entries. You can’t contact the experts outside of chat board platform. Sharing any personal information, including but not limited to contact information, goes against our Terms and Conditions and therefore may result in permanently blocking you from the platform. We take any personal data very seriously and we do it for the safety of our users.

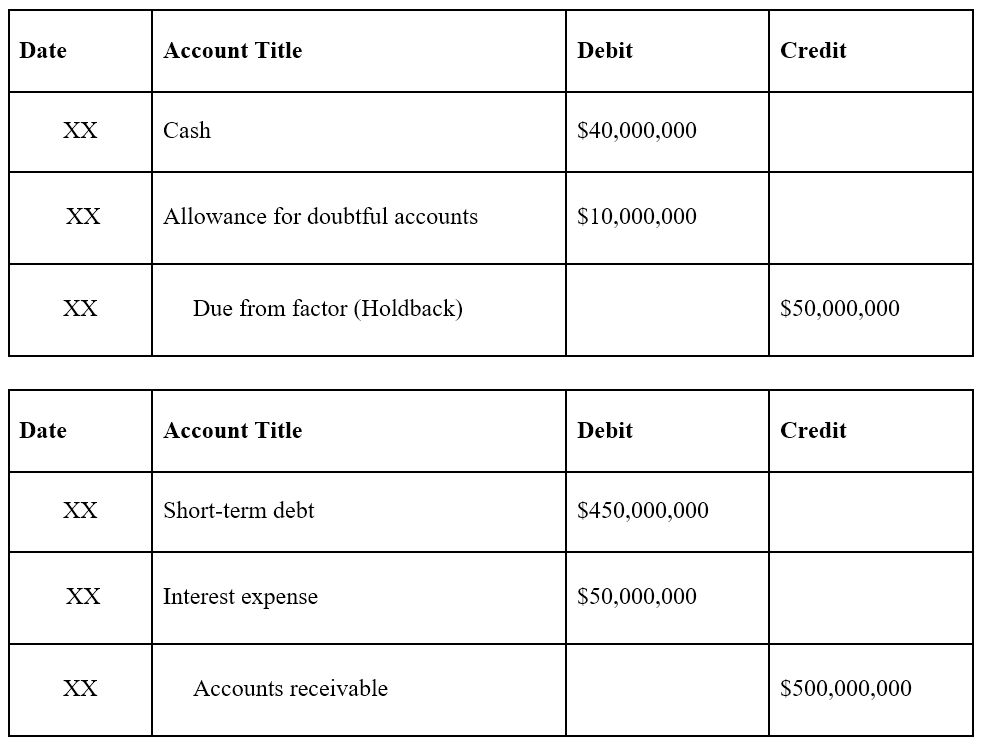

In the value of liability the particular liability account gets credited and vice-versa. Creditors a/c, Bills payable a/c, Bank loan a/c etc., are a few accounting opening entry most common examples of liability accounts. The accounts on the left side of the accounting equation are reported on the left side of the balance sheet.

AccountingTools

The accounts with the balances in the previous year, comprising Real and Personal Accounts are… Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. The opening balance is used in the beginning of a financial plan on the opening balance sheet. The length of time that a company has been operating determines what should appear on the opening balance sheet. In addition, opening balances are important if you transfer your accounts from one accounting system to another.

What are the types of opening entry in accounting?

The Opening Entries is the balance sheet amount which is brought forward at the beginning of an accounting period from the end of previous accounting. The opening balance consists of Assets, Capital & Liabilities of the company brought from previous year's Balance sheet.

The beginning of every financial year in which he shows all the opening balance of assets and all the liabilities include capital. Then that journal entry is called opening journal entry. Because all assets have debit balance, so these are debited in opening journal entry and all liabilities have credit balance, so these are credited in opening journal entry. Thus recording the entries for bringing in the value of closing stock into books may not be complete by the time trial balance is drawn up.

Current Year Balance Sheet Showing Current Year Earnings

So, it becomes important to rectify these values to make a proper adjustment. The best practice is to close opening balance equity accounts off to retained earnings or owner’s equity accounts. A professional bookkeeper will help you ensure your books are up-to-date and accurate. Click here for a free trial of the FreshBooks bookkeeping and accounting services now. The debit or credit balance of a ledger account brought forward from the old accounting period to the new accounting period is called opening balance.

All entry will be displayed in the payable account from the GL Adjustment Date, Description and Value. All opening balance entries will require an offsetting balancing entry. On the Adjustment – Right Account line, enter the Opening Balance value for this payable account. On the Sub Account line, lookup the supplier/payable account name. Use the binoculars to select the account from a list of matching names. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Want More Helpful Articles About Running a Business?

We credit the Trading a/c or Cost of Goods Sold a/c for bringing the value of closing stock into books only if we are recording the value of closing stock at the time of preparation of final accounts. In such cases we credit the Purchases a/c in the journal entry for recording the value of closing stock. Opening, as well as closing entries, are the simple terms through which an entry gets its actual motto, either the transaction gets closed, or it carries to the journal account of the current year. Now, there are many entries which are very important, but the accountant can neither carry nor close.

The balance of each partner’s capital account after the opening transaction is equal to his original investment. The total assets and liabilities of the firm are equal to the sum of assets and liabilities of all partners after this transaction. Opening balances can be entered all at once or at different times depending on what works best for you. For example, if your accountant previously processed your accounts for you, they may not have sent you your full trial balance yet.

Closing entries

We will go over opening balance equity, the reasons it’s created, and how to close it out so your balance sheets are presentable to banks, auditors, and potential investors. Close the income summary account by debiting income summary and crediting retained earnings. Are you looking for a pro forma income statement template Excel for your business? Discover the definition of the pro forma income statement, its purpose, how to create a pro forma statement and free pro forma income statement template Excel to download. An opening entry is the initial entry used to record the transactions occurring at the start of an organization. The contents of the opening entry typically include the initial funding for the firm, as well as any initial debts incurred and assets acquired.

The last line on the balance sheet, most likely in September, the final month of the fiscal year in the US, will list all of the assets they have at the end of the year. In such a case, the opening stock, current period purchases and the direct expenses thereon are transferred to the Cost of Goods Sold a/c. The adjustments relating to closing stock and stock used for purposes other than trading are also be made through this account so that the final balance in this account would be the cost of goods sold.

How do you calculate the opening balance?

“Man makes errors.” It is true that errors can take place while entering the transactions and it is also true that modification, in that case, is very important. Many times an accountant is unable to understand the exact data, but at the time of preparation of balance sheet or any report for a particular period the error gets trapped by him. The reason is the proper balance of debit part and the credit part. It is very important for a transaction report to have an equal value of the debit part as well as credit part. When an error occurs, then unequal debit and credit amount indicates that there is an error.

- This would also create, of course, some entries in my G/L and I need to reset those.

- The Accounting University with 3400+ Accounting contents as study material which can watch, read and learn anyone, anywhere.

- The Cash Book on page 1.20 shows that the Indian Tobacco Co. had, on April, 30, a sum of Rs 1,150 in cash and that on the same date, the company owed to bank Rs 50,250.

- Go to the menu Accounting ‣ Customers ‣ Customer Invoices to post your outstanding sales entries.

- These equity accounts are just labeled differently to represent the ownership or form of a business.

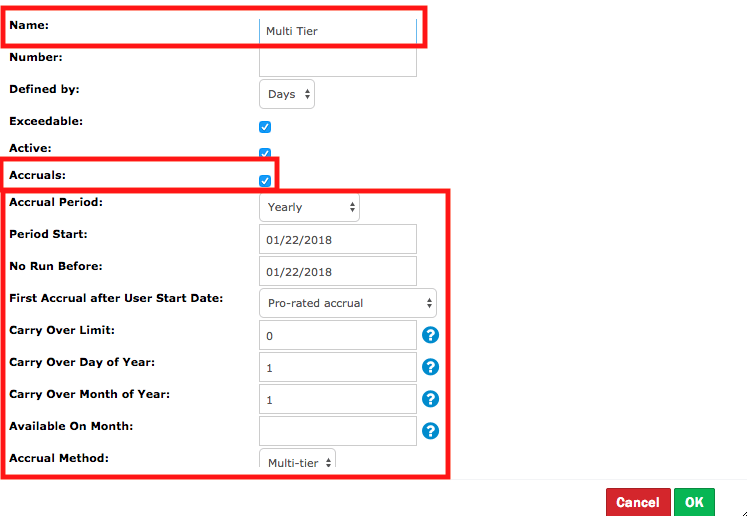

If you have additional Payable Opening Balances ready for entry, continue to enter them as shown in Figure 3. We will use December 31, 2010 as the date for the opening balance entries. It would be in your best interest to complete these entries within the first month after your Go Live Date. Entries for Account Payable Opening Balances can be entered at any time after your Go Live date.

What is opening and closing entries in accounting?

Essentially, all opening entries of a new fiscal year are the exact entries and figures of the previous period's closing entries. Therefore, the beginning balance of these accounts can be taken from the previous period closing account balances.